Here’s Everything that Goes Into A Rock-Solid Comparative Market Analysis

Ten seconds. That’s all it takes for someone to decide whether they’re interested in buying your home. And chances are, you’ll never know they were looking. It’s not even happening at your house. It’s happening on someone’s phone or tablet anywhere on the planet.

With first impressions at such a premium, it’s no surprise that figuring out the perfect asking price is an essential first step to the successful sale of your home. (Go too low, and people will wonder what’s wrong with it. But price too high, and buyers won’t give you a second look).

If they see that your price is out of line, they’re not going to bother to come because they’re just going to conclude that the seller is unreasonable. They’ll go somewhere else, even if the house is drop-dead gorgeous.

So how do you find that perfect asking price? Enter the comparative market analysis.

What Exactly is a Comparative Market Analysis (CMA)?

Known in the real estate business simply by its acronym, a CMA is a powerful tool that rounds up similar properties in your area to help determine your home’s value.

Since no two homes are the same, a well-executed CMA is equal parts art and science, comparing raw data, such as your square footage and home address, with the less tangibles, like your home’s proximity to noisy streets. It’s an absolute essential when nailing down an initial asking price, and important for buyers making offers, too.

Your real estate agent will prepare a CMA by examining about 5-8 properties that are comparable to your own home in location and size to figure out an appropriate initial asking price. Getting a CMA from your agent is often one of the first steps you’ll take in listing your property.

Should You Shoot for the Moon on Your First Price Attempt?

The importance of pricing your home right the first time can’t be understated.

There are obvious downsides to listing a property too low, but too high an ask can be just as detrimental. Buyers will often conduct their own CMAs and will be able to easily spot an incorrectly priced listing.

Even if someone bites on a too-high price, the bank may become the bearer of bad news.

Mortgages only cover the appraised value of a property—meaning you or the buyer will have to make up the difference, or meet somewhere in the middle.

What Makes A Good Comparative Market Analysis?

Let’s take a look through this 33-page sample CMA and find out what to look for in a well-researched report.

The Comparative Market Analysis Starts With Location, Location, Location

The most important step in a CMA is accurately defining your neighborhood. One common mistake is drawing a perfect circle radius around your home, but that’s not always the most accurate approach. If you go across a busy street, a set of railroad tracks, a creek, everything can change.

Instead, you’ll want to look at houses within your neighborhood, which might be narrow or zigzag or fall outside the boundaries of a neat radius. In this CMA on page 31, we see properties specifically to the south and the west of the homeowner’s address (S), rather than scattered throughout the map.

Comparative Market Analysis: Expectations Versus Reality

As anyone who’s sold a home before knows, there may be a big difference between what you list your home for and the price at which you sell your home.

That’s why you shouldn’t use homes’ “list” or asking price as points of comparison when creating a CMA. When you’re looking through your CMA report, be sure that most of the properties listed as comparables were actually sold, not just put on the market.

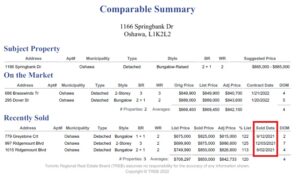

As we see in this CMA example, all 3 homes are marked “SLD” for sold and 2 are marked “NEW” for just listed.

Timing is (Almost) Everything: Use Recent Sales for Your Comparative Market Analysis

On page 6 of the CMA, we can see the sale dates of the comparable homes. In a typical CMA, you’d want all the properties to have sold within the past 4 months, and ideally within the past month.

However, there are plenty of reasons to go back further. Location trumps sale date, so it’s better to compare similarly located properties than to introduce ones that aren’t quite in the right neighborhood.

Everything Is a Factor When Comparing Your Home to Others

A good CMA should compare your home to others that are within 100 to 200 square feet in size, the difficulty is that most listings do not include a total square footage value. Equally important is similar size of the lots.

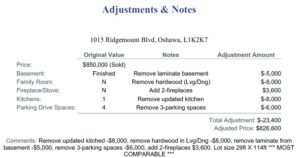

Comparing “apples-to-apples” in the same vicinity of the subject property is of utmost importance. As I mentioned earlier “no two homes are the same”. Adjustments have to be made for the age of the homes, recent renovations and upgrades to roofing and mechanical systems; and yes even flooring, parking spaces and garage type just to name a few.

Those adjustments are made to the “comparable property” to equalize the features evident in the “subject property”. For example if the subject property has two fireplaces and the comparable only has one, the additional cost of one fireplace needs to be added to the comparable property value. Likewise if the comparable property has a 2-car garage and the subject property has a 1-car garage, a deduction of that different value needs to come off the sold price of the comparable property.

Interestingly, bedroom and bathroom count is less important in some higher-value markets. In some areas, people are willing to do anything just to get a house, making the specific bedroom count less important. They’ll turn a family room into a bedroom if they have to. However, in the $1,500,000 to $1,100,000 range, extra bedrooms and bathrooms can add serious value.

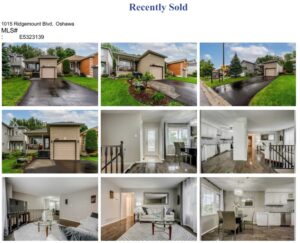

Interior Photos of Comparable Sales? Those Are Worth 1,000 Words

In the example CMA, notice the photos under each comparable property. A good CMA will include interior pictures that help inform what drove the sale price of the home. It’s from the interior photos where you can really identify the differences such as flooring, renovations and condition of the home. Interior home photos are critical to a quality CMA. They highlight features that impact your price.

A poorly done CMA may only include exterior photos. Enabling you to only identify differences in exterior cladding, possibly parking spaces, decking and landscaping. Really not much value.

Because a CMA is an art and a science, it’s important to have your CMA note the extra features of a home that an automated home valuation might miss. An updated kitchen, renovated bathrooms, and professional landscaping all can drive the price of a home and should be accounted for in an good CMA.

A Comparative Market Analysis Sounds A Lot Like an Appraisal. What’s the Difference?

Appraisals and CMAs are actually very different. First let’s look at the purpose of each one.

Homeowners use CMAs to determine an asking price and buyers use CMAs to inform their bidding. Appraisals, on the other hand, happen so that a bank can lend an appropriate amount of money for a mortgage after a buyer makes an offer.

A poorly crafted CMA can delay a sale, but a less-than-perfect appraisal can lead to much more serious consequences like mortgage fraud and lawsuits. That’s usually why appraisals are left to those with certifications from the province in question.

Even though an appraisal mostly helps a bank lend appropriately, the buyer is on the hook to pay for it. The cost of an appraisal usually falls in the $500 to $700 range.

CMAs, on the other hand, should be part of the service package offered by your listing agent.

Can I Just Perform a Comparative Market Analysis Myself?

You could, but an agent will probably do a much better job.

One thing you can do is use an automated home value estimator to get an idea of what your home might be worth. But think of these online tools as a starting point, whereas a CMA is the entire picture.

You can look at the prices of homes in your area to pull some rough comps, but some of the data that goes into a CMA may not be as readily available to you as it is to a real estate agent.

In addition, certain tools that help agents create CMAs, like Home Price Index and GeoWarehouse, can provide specific historical information to help back up the findings of a less-than-favorable CMA. You’ll find an agent can also conduct a CMA much faster than the average non-real estate professional. It usually takes me about 4-hours to assemble a residential one and considerably longer for a commercial evaluation.

Is there a charge for Property Evaluations?

My clients receive complimentary annual “Real Estate Health Check” reports at no charge, customized to show recent comparable properties sold in their neighborhoods’.

Curious about how much your home or investment property would sell for in today’s market?

Please complete the form below and I would be happy to arrange a Residential Property Evaluation for $495.00 or a Commercial Property Evaluation for $ 1,245.00.

Both of which are refundable if you become a client and list your property with me.