Investment strategies for 2024 range from selling overpriced industrial assets to taking a full accounting of the top Commercial Real Estate risks.

With the holiday weekend behind us, it is not too soon to look at what will be the top investment strategies for next year. They include:

1. Sell Overpriced Industrial Assets

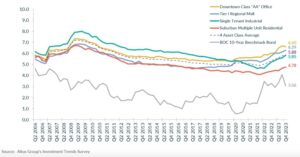

The industrial market has been booming for the last few years and is the favored asset class among institutional investors. While demand for industrial product remains strong, the cap rate for single-tenant industrial product jumped to 5.85% in Q3 2023. An increase in cap rates was seen across all markets. Industrial assets continue to experience pent-up demand as supply lags absorption, constraining existing tenants in terms of expansion. With the cost of borrowing getting higher and construction costs remaining elevated, investors were facing potentially negative leverage when seeking deals in the asset class, which are becoming increasingly difficult to justify for some. The national industrial availability rate increased to 4.3%. Five of the eight major markets experienced an increase in their cap rate quarter-over-quarter, except for Vancouver and Edmonton (both unchanged) and Calgary (down).

2. Sell Overpriced Multi-Family Assets

As house prices continue to climb despite the volatility in the market, an increasing number of consumers continue to turn towards rental housing. This demand is further driven up by the implementation of government support programs and increased immigration. Cap rates for suburban multi-unit residential assets increased in Q3 2023 to 4.78%. The suburban multiple-unit residential cap rate increased by 0.11% quarter-over-quarter. Cap rates across all markets were mixed. Half experienced an increase, while the other half remained unchanged. Quebec City and Montreal recorded the highest increase of 0.3%. Lack of available inventory and increased demand is creating a “hot” market for this asset class as well.

3. Acquire Beaten up Retail Assets

The top three most preferred property types by investors in the third quarter of 2023 were food-anchored retail strip, industrial land and multi-tenant industrial assets. The food-anchored retail strip and industrial land assets had the largest upswing in momentum ratio. Food anchored retail continues to remain an attractive asset with its nature as an essential asset and potential for expansion.

The top three preferred property types by investors in the fourth quarter of 2023 were suburban multiple-unit residential, multi-tenant industrial, and food-anchored retail strip, respectively. Limited inventory has driven the steady and strong demand for multi-family and industrial products. However, a return to moderation has been observed in the fourth quarter after the feverish demand reported in the first half of 2023. Moreover, as flexible work arrangements have become commonplace in Canada, more time has been spent at home and in local neighbourhoods, which has allowed community-level retail centres to thrive.

Challenges created by elevated interest rates and underlying inflationary pressures have led investors to rebalance their portfolios with low-risk assets providing stable returns, such as residential, industrial, and food-anchored retail.

4. Invest in Data Analytics Companies

One of the key growth areas of CRE is in data analytics. This business has low capital costs and high returns on equity by selling data to the CRE industry. Data analytics encompasses all aspects of big data for CRE including demographics, ownership data, property data, historical value information, sales/lease data and financial analysis. The data analytics space is very fragmented with a few large companies like CoStar, RealPage, REIS (a unit of Moody’s) and Real Capital Analytics and many smaller local and start-up companies. These larger firms have been acquiring smaller competitors to expand their service offerings and customer base. As the industry grows, there will be more consolidation and an opportunity to acquire these smaller private firms and even establish a platform to consolidate these entities or sell them to larger firms. The large CRE software firms are also prime buyers for data analytics companies as they seek to diversify their software business and crosssell the data analytics products.

5. Sell Overpriced Core Assets and Reinvest in Opportunistic Assets

The risk and return for various CRE investment strategies range from the lowest risk, core investments, which are typically fully leased, institutional quality, Class A properties with little or no leverage, to value-added strategies which are higher risk strategies that involve some property redevelopment, tenant adjustment or leasing or with operational problems to opportunistic strategies, which are the highest risk category that involve a high degree of redevelopment, leasing, tenant relocation or change or may be in financial distress. Many core properties are still trading at 4.0% to 5.0% cap rates and should be sold.

Institutional investors typically focus on the risk and return characteristics of various CRE investment strategies. The lowest risk is core and core plus investments, which are typically fully leased, institutional quality, Class A properties with little or no leverage. The next riskiest investment strategy is value-added strategies which are higher risk and involve some property redevelopment, tenant adjustment or leasing or with operational problems. The riskiest sector are opportunistic strategies, that involve a high degree of redevelopment, leasing, tenant relocation or change or may be in financial distress. Many core properties are still trading at sub-5 % cap rates and should be old. The proceeds should be reinvested in higher return opportunistic strategies, as discussed in #2 above, buying beaten up retail assets.

6. Provide Participating Mezzanine Loans

Even though there is a lot of capital sloshing around chasing deals, there is a dearth of debt/equity capital for the portion of the capital stack above the first mortgage at about 65%-70% and below the minimum owners’ equity investment of 10.0%. This slice of 20% of the capital stack is ideal for a participating mezzanine loan. The participating mezzanine loan may have terms as follow; the central bank’s risk free rate of interest 3.0% (comparable to 10-year bond yield) plus an additional interest rate spread to compensate for the risk associated with with the transaction. This spread in some cases varies between 4.0% – 10.0%+, loan fees of 1.0%-3.0%+ and 20.0% to 30.0%+ ownership of the deal. The mezzanine lender will typically not be secured by a second lien on the property but by an ownership guarantee and assignment of the owner’s interest in the property. The lender is entitled to the equity kicker because it is taking some of the equity risk of the project. Internal rates of return of 12.0%-20.0%+ can be delivered with this strategy, which is very attractive for a fixed income investment.

7. Perform a Systematic Review and Analysis of the 15 CRE Risks

As we have discussed before, there are 15 risks inherent in CRE investment as follows:

- Cash Flow Risk-volatility in the property’s net operating income or cash flow.

- Property Value Risk-a reduction in a property’s value.

- Tenant Risk-loss or bankruptcy of a major tenant.

- Market Risk-negative changes in the local real estate market or metropolitan statistical area.

- Economic Risk-negative changes in the macroeconomy.

- Interest Rate Risk-an increase in interest rates.

- Inflation Risk-an increase in inflation.

- Leasing Risk-inability to lease vacant space or a drop in lease rates.

- Management Risk-poor management policy and operations.

- Ownership Risk-loss of critical personnel of owner or sponsor.

- Legal, Title, Tax and Political Risk-averse legal, tax and political issues and claims on title.

- Construction Risk-development delays, cessation of construction, financial distress of general contractor or sub-contractors and payment defaults.

- Entitlement Risk-inability or delay in obtaining project entitlements.

- Liquidity Risk-inability to sell the property or convert equity value into cash.

- Refinancing Risk-inability to refinance the property.

All investors that own CRE should perform a detailed and systematic review of the above risks and their potential effect on an asset or portfolio.

Inflation is falling in most of the major economies around the world, meaning greater predictability is returning to consumer and producer prices – and to construction costs too, even if they will remain high. Interest rates in most developed economies have now peaked after aggressive monetary tightening in 2022 and 2023, and policy rates are likely to be stable until the cutting cycle begins in mid-to-late 2024. With future policy rate movements likely to be downward, borrowing costs will fall. Market rates may still face volatility, but the direction of travel is now downward, providing some predictability to future debt costs. Pandemic-related disruption – to consumer shopping habits, international trade, and e-commerce – have now largely settled and will bring logistics demand more in-line with historical growth trends where development pipelines are slowing in more mature markets. In Canada, return-to-office mandates have become more widespread, and we expect utilization to continue to increase incrementally in 2024, and revitalizing CBDs with renewed daytime foot traffic and retail demand.